Reducing carbon emissions in the label industry

Mike Fairley looks at the challenge faced by the label industry to reduce carbon emissions and argues for more joined-up thinking, industry collaboration, and carbon footprint reduction measures

One of the key challenges facing the label industry today is that of reducing its carbon footprint. Pressures on the packaging and label industries to reduce carbon emissions are being driven by governments, brand owners, major retail groups and consumer organizations; more and more demands are being made for carbon footprint labeling on packaging, while packaging users are looking to significantly reduce their carbon footprint in the supply chain.

In the UK for example, the Climate Change Act in 2008 made the UK the first country to set out a framework for the transition to a low carbon economy – with a plan to cut carbon emissions by 80 percent by 2050, and an intermediate target of a reduction of between 26 percent and 34 percent by 2020.

Many of the national and international retail groups have also set out ambitious carbon reduction plans. Tesco, one of the world’s leading retail groups, aims to slash its environmental footprint by 30 percent by 2020. Trials began a year ago to set up a supply chain collaboration hub, overseen by consultancy 2degrees. Major suppliers such as Diageo and Coca-Cola have already joined the group and Tesco is now looking to get its top 1,000 suppliers involved by the end of 2012.

In the USA, Wal-Mart, the world’s biggest retailer and owner of Asda, has long pledged to slash its carbon footprint by barring products that contribute to global warming from its shelves and is looking to its suppliers to reduce 20 million metric tons of greenhouse gas emissions by the end of 2015. The company has already been working with suppliers in the past few years to reduce its packaging footprint.

In France, the French government launched a pilot program to get multinational firms involved with carbon footprint labeling. Already companies including Unilever, Heineken and Proctor & Gamble are applying carbon labels to products. Indeed, the pilot has proved to be so popular that some companies volunteering to take part even had to be turned down.

Back in the UK, Sainsbury’s supermarket is introducing new on-pack information aimed at helping shoppers make what it calls ‘more sustainable purchasing decisions.’ New packaging designs introduced by the supermarket are reported to have already generated an 11 percent reduction in packaging weight over the past two years.

So how are all these initiatives impacting on the label industry? Certainly some of the leading label companies and groups have achieved significant sustainability and/or carbon reduction targets. Spear is undoubtedly a good example of this. Many of the main industry suppliers have also been working on initiatives, developing new or modified products, looking at new solutions, calculating carbon emissions, or introducing new materials. The industry has certainly moved forward over the past few years.

The publication by Tarsus in September last year of the ‘Environmental Performance and Sustainable Labeling’ handbook to becoming a greener label converter has also helped to raise awareness and guide the industry into taking further steps towards a more sustainable future. Any label company, whatever its size, should be able to make use of this publication to good benefit.

Having said that, the label industry cannot afford to rest on its laurels. The number of label converters or industry suppliers that have documented carbon footprint reduction targets is probably a small fraction of the total industry. Indeed it is perhaps difficult for the many smaller label converters to dedicate time and cost to creating and implementing such targets.

And this is at a time when governments, brand owners and retail groups are stepping up their demands and looking to move forward more rapidly with carbon reduction in the packaging and labeling supply chain. Certainly, the next few years will see an even bigger push on reducing carbon emissions – and the introduction of global ‘carbon credits.’ The label industry has yet to feel the full brunt of these new challenges.

Yet, if the label industry is to convince brand owners, consumer groups and governments that labels are not a part of the problem – as it is often portrayed, and particularly for self-adhesive labels and release liner waste – then labels need to be promoted more as a means of carbon reduction. This is going to need a more collaborative relationship between industry suppliers, more positive marketing and PR, more good news stories, and definitive steps towards significantly lowering emissions.

As Jussi Vanhanen, president of UPM Raflatac, stated at the recent L9 global industry forum in Tokyo, ‘It is more important than ever for the industry to focus its efforts on the efficient use of raw materials and resources. Doing nothing is not an option.’ His presentation was part of an L9 initiative aiming to stimulate global awareness and collaboration for recycling and sustainability in the self-adhesive labelstock industry. He also invited label printers and end-users to join labelstock suppliers in supporting the efficient use of raw materials and resources by promoting environmentally sound options.

While the main labelstock suppliers are already starting to measure and reduce carbon emissions in their manufacturing and distribution chain, there are many other areas of label printing and converting where carbon emissions have an impact. How much do we really know about all of these? Inks and ink manufacture have a carbon footprint; label presses and the printing process have a carbon footprint; UV-curing has a carbon footprint; waste disposal and recycling has a carbon footprint; despatch of labels to the customer has a carbon footprint.

From talking with many of the leading industry suppliers at the recent Finat Technical Seminar it seems that many of them are already starting to calculate the carbon footprint of their part of the label manufacturing supply chain. For example, Sun Chemical is working on this for some of its inks; Avery Dennison for substrates; GEW for UV ink drying; EskoArtwork for pre-press; Gallus for presses; Channeled Resources for recycling waste. Others are also embarking on measuring and recording CO2 emissions.

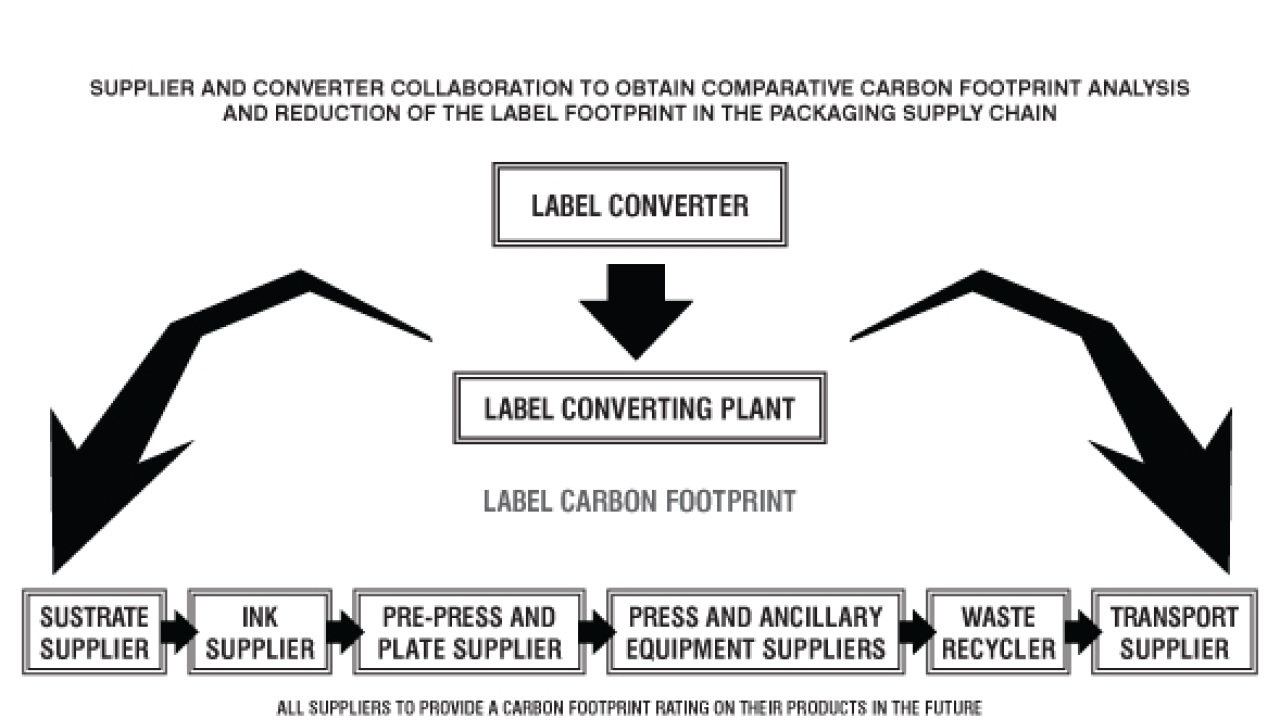

However, what the industry really needs now is to achieve some joined-up thinking and improved supplier collaboration to fully understand where carbon emissions are created in the label industry supply chain, what elements of the label manufacturing process have the main impact, where reductions can and should be made, and then fully promote and market every major step forward in carbon reduction.

Maybe label industry suppliers in the future will have a carbon footprint figure for their products on their own labels when despatched to the label converter. After all, if the major retail groups are putting a carbon footprint value on the product labels, why shouldn’t label industry suppliers be doing the same?

It will probably also be necessary to work closely with label application and end-user companies. This way, the carbon footprint of the applied label might eventually be determined, and a true comparison against other forms of labeling obtained. Certainly, the applied label carbon footprint of shrink and stretch sleeve labels is already being promoted. How does the carbon footprint of self-adhesive and other forms of labeling compare with these, or with wrap-around film or in-mold labels?

How can we effectively market and promote self-adhesive labels in an ever-more demanding carbon footprint reduction world if we don’t have all the answers? Let’s embrace the challenge and move forward to a more collaborative, joined-up, informed and positive future.

Pictured: Supplier and converter collaboration to obtain comparative carbon footprint anaysis and reduction of the label footprint in the packaging supply chain

This article was published in L&L issue 3, 2012

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.