Mexican market in focus

A pre-Labelexpo Mexico webinar hosted a panel featuring Sandy Almirall, president of the North America region at converting group All4Labels; Carlos Uribe, general director of material supplier Arclad Mexico; and Ari Vonderwalde, CO/CEO of Mexican converter Etiflex. James Quirk, the webinar’s moderator, provides highlights from the discussion

L&L: Are you excited about attending the first-ever Labelexpo in Mexico, and why do you think the country is a suitable venue for the event?

Carlos Uribe: We’re delighted that Mexico has been chosen as the location for this event. The country is a reference point for the wider region in terms of having an impressive number of label converters with very good technology.

Sandy Almirall: We’re very happy about the event being here. Mexico has great opportunities. The label industry is very strong. It will be great to see people and new technologies and to see what is happening and where the industry is going. We’re really excited about it.

Ari Vonderwalde: I’m very excited, after so many years of craziness, that we can be back at one of these events in our country. The label industry here has been growing strongly and has professionalized a great deal. It can compete at a world-class level. As a 100 percent Mexican company, it is a pleasure and an honor for us that Mexico is the host of the event.

L&L: What are you looking forward to seeing at Labelexpo Mexico 2023 in terms of technology?

Uribe: We have a stand at the show and are launching some new materials that adhere to industry trends such as environmental sustainability. During these exhibitions, we also like to see what new machinery is being shown and what is coming, because we need to continue to adapt our materials and our service to what the converters need.

Vonderwalde: We see an evolution and a revolution happening in our industry with regard to automation, so I am particularly interested in seeing the advances in the automation of processes.

We are also interested in seeing digital technology and how it continues to evolve. Also, digital embellishment, which is fashionable at the moment and which can replace some complex and expensive processes. And software and artificial intelligence, RFID, this sort of thing. And of course, environmentally sustainable products.

Almirall: We are also very focused on digital, so are interested in seeing what will be shown in this area. We are also working with hybrid technology and are introducing digital into some of our flexo and offset processes.

I am also interested in seeing any rotogravure technology and materials for shrink sleeves, anything which can help make us more efficient, sustainable and automated in rotogravure printing.

L&L: According to Mordor Intelligence, the Mexican label market is expected to register a CAGR of 5.5 percent from 2021 to 2026. Does this match your experience over recent years, and do you expect the growth to continue? Where do you see opportunity in the market?

Vonderwalde: Yes, we are experiencing good growth. It is due to various factors and depends on the market verticals in which we are operating.

Nearshoring and the geopolitical situation of the country are generating growth and I think this will continue. And, above all, it’s a result of the professionalization and the technological development of the market. As Abraham Lincoln said: ‘The best way to predict the future is to create it.’ And this is what we are doing, creating it.

Almirall: At All4Labels we have great confidence in the Mexican market. Our predictions are for optimism and growth. Nearshoring is creating a huge opportunity and a boom in manufacturing. We have to be agile to make the most of it. A window of opportunity has opened and those who thrive will be those who are quickest, most flexible, most productive, and most organized. We see Mexico as a platform to serve the United States and Canada, and a platform to produce world-class work. It has the talent; it has the technology. One market, in particular, I want to mention is wine and spirits, which is exploding. Mexico is a big producer of tequila and the wine sector is growing, and these require high-value labels.

Uribe: I agree with Ari and Sandy that nearshoring and the arrival of foreign companies are creating a good moment for Mexico. In terms of specific markets, I would mention the automotive and food and beverage sectors in particular, and retail and eCommerce too. Mexico is one of the fastest growing markets for Arclad and we continue to invest in the country.

L&L: What are the challenges of doing business in the local market?

Uribe: For material suppliers, Mexico is a very competitive market. Consistency of service and product quality is key. We always have to keep innovating in order to stay competitive.

Vonderwalde: From a macro point of view, inflation and high-interest rates are challenges for converters. At a more local level, governmental bureaucracy can be quite heavy and can be a challenge which makes our work more complicated. And within companies, it is a challenge to work more efficiently and train our workforce to overcome these barriers.

Almirall: Inflation is a macroeconomic pressure that affects us all and requires us to be very productive and creative to maintain growth. You can’t simply pass on the higher costs to your customers. We are in a highly fragmented industry; there is a great deal of competition. Finding talent is another challenge.

A company is made by people. The extent to which we have the right personnel – motivated, aligned, with a good understanding of where we are heading – affects how we can achieve our objectives.

L&L: To what extent are the supply chain issues caused by the pandemic now resolved? Are there still knock-on effects? Is there a long-term legacy?

Vonderwalde: The biggest impact that can still be seen is in time-to-market, both from our suppliers to us, and from us to our customers. During the pandemic, and for around a year afterward, the supply chains were broken. This created huge delays in deliveries in general. The concept of time-to market has been lost a little. This is a negative legacy, which is evolving and slowly returning to what it was before. The shortage of materials is no longer a problem.

The industry is very dynamic at the moment and even just three months ago we might be saying different things.

Almirall: We have emerged from a critical phase when it was a huge challenge to keep factories open. It is a different time now, but inflation and rising costs are among the knock-on effects and the industry has to work together to try to bring things back to where they were before. During the pandemic, we were faced with challenges that were very difficult to overcome. We had to be very flexible and creative. There is a positive effect from this – today, when faced with a challenge, we know what we are capable of and we have incorporated those lessons into our operations.

Uribe: The supply chain problems are largely resolved but inflation and high costs are definitely a result of the pandemic. But things have been getting better and we hope that this year and next year will be more normal as investment returns and initiatives such as nearshoring have an impact.

L&L: How has the local market evolved in recent years in terms of the technology being installed by Arclad’s customers, and the materials they are buying from you?

Uribe: It has been a good period in the Mexican market and we see our clients investing in new equipment, particularly in digital and hybrid technology. They have added capacity and are printing at wider web widths. In terms of what we sell, the biggest growth has been in materials for applications with variable information. We estimate that around 45 percent of the materials sold into the Mexican market are for these applications. This is because of retail, e-commerce and logistics. And for environmental reasons, there is increasing interest in materials with reduced weight.

L&L: Sandy and Ari, what technology have you been installing at your plants in recent years?

Almirall: For us, digital has been the main focus. It has allowed us to be faster, and to handle short runs more quickly. Our clients want personalization and this creates shorter runs with more versions. We see digital in two ways: traditional digital printing, and hybrid, where we can incorporate digital in-line with our flexo and offset systems. This allows us to add certain types of finishing to our products in a fast and efficient manner. We’ve also been looking at rotogravure technology with wide web widths and high speeds for shrink sleeve production.

Vonderwalde: We have invested in digital printing and digital finishing, which allow us to fulfill various needs in the market. We have also invested in the production of RFID and intelligent labels, as well as in software that automates processes in order to increase operational efficiency.

L&L: Do you also serve the Central American market from Mexico, and where do you see opportunities there?

Uribe: We have offices in Central America, which have also been experiencing good growth. The textile sector is strong there, as is the agro-industrial market. The region produces a lot of fruit so that is another big market.

Almirall: We do serve the Central American market, both from Mexico and also our operation in Brazil. Usually, our customers are converters who also have a presence in Mexico or in South America in addition to Central America.

Vonderwalde: We sell to certain segments in Central America. It is a smaller market, of course, than North America, and there can be logistical challenges in terms of delivering labels.

L&L: What trends do you see in the Mexican flexible packaging market?

Uribe: There needs to be an evolution towards the ecological, towards lighter-weight materials that do not compromise on performance and that is more easily recyclable. This is how flexible packaging needs to evolve and we can see that many companies in the sector are focused on these areas. Consumers want environmentally sustainable packaging, whether that be flexible packaging or labels.

Vonderwalde: Without being very much involved in this market, but knowing it pretty well, we can see that it is growing and will continue to grow because of the qualities it can bring.

Here we can get into the debate about whether plastic is the devil – which it isn’t. But when you begin to dig a little deeper, you can understand the circular economy and what is recyclable and compostable and you can see that it can fit within a sustainable society. So I see it continuing to grow. It allows you to have a 360-degree graphic around the product which helps it stand out on the shelves in a very competitive market.

Almirall: Flexible packaging is something that really draws my attention. I spent many years working in the rigid packaging sector, and there is great rivalry between the different formats. Depending on the needs of the consumer, there are flexible packaging solutions that are very innovative, such as refillable and resealable packaging which can be more sustainable than rigid packaging. So there is a lot of competition between flexible plastic packaging and rigid plastic packaging. It depends on the needs of the consumer and the market.

L&L: Is the Mexican market ready for RFID or does the technology still need to be fine-tuned?

Vonderwalde: There is no question that if you are prepared, there are hugely diverse and unimaginable applications for RFID. It helps bring products closer to the consumer, and it can bring huge efficiencies. There has always been the question of its cost: an RFID label is much more expensive. But the market is more than prepared for it – it is the present, rather than the future – although of course, it will continue to evolve.

Almirall: We see RFID as an important trend and are looking at how it can be incorporated in an accessible and efficient way. We believe in it. I think there will continue to be an evolution in the technology and how it is produced. It has been a great success in Europe in terms of its functionality but also in terms of cost and the benefits it brings to clients.

L&L: Mexican association Canagraf estimates that there are 450-550 label converters in the country, up from 300 a decade ago. Have you seen a lot of new companies become customers in recent years?

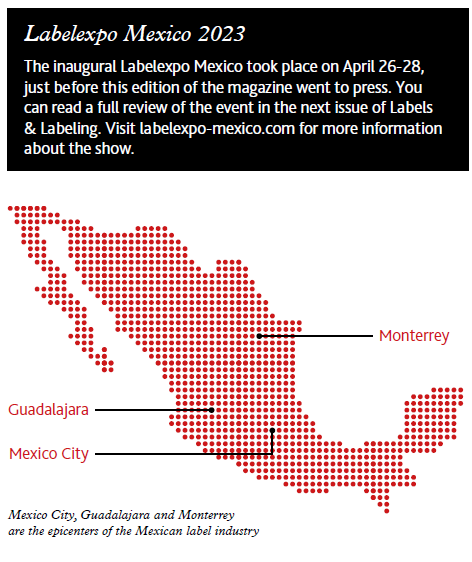

Uribe: I don’t know the exact numbers, but we’ve been operating in Mexico for around 12 or 13 years and we have seen the number of companies rising. Mexico City, Guadalajara and Monterrey continue to be the main centers of the industry, but you can find converters all around the country. There is a great variety in size, from big companies to smaller ones with just one or two machines. I think there has been a particular rise in Monterrey and the north of the country in terms of converter numbers and converter growth.

Stay up to date

Subscribe to the free Label News newsletter and receive the latest content every week. We'll never share your email address.